There are over 34 million Americans living with diabetes and another 88 million with prediabetes. The American Diabetes Association (ADA) is working hard to bend the curve on this epidemic through diabetes research, advocacy, and programs—but we can’t continue our lifesaving work without your generosity!

Do you want to take part in this fight against diabetes and to improve the lives of millions of Americans while helping to fund research towards a cure? Do you want to ensure a steady stream of income for yourself or one you love? A charitable gift annuity may be an excellent option for you.

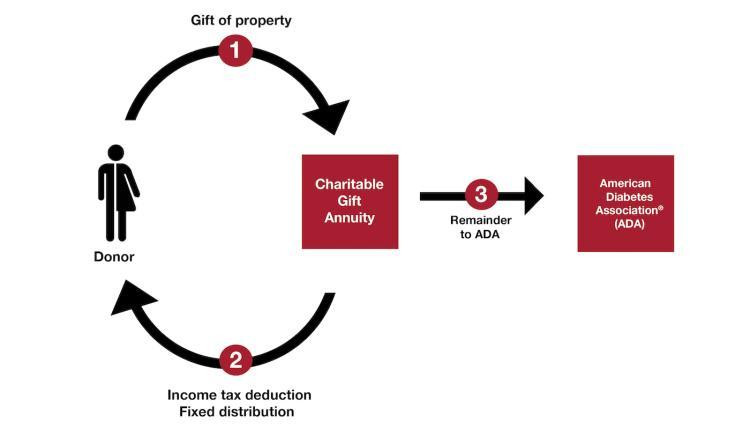

A charitable gift annuity is a simple contract between you and the ADA. In exchange for your gift of cash or other assets—guaranteed, regular fixed distributions are made to you for your lifetime.*

REQUEST YOUR PERSONAL ILLUSTRATION TODAY!

Here’s how a charitable gift annuity works:

- You transfer cash or other assets to the American Diabetes Association.

- You will receive fixed distributions—the amount of your payment is determined at the time your gift is funded. The amount you receive will not change with interest rates or changes in the investment market.

- You may benefit from an immediate charitable income tax deduction for a portion of the amount used to fund your gift annuity, which may reduce your federal and/or state income tax.

- A part of each distribution is tax free for a certain amount of time.

"When I got my charitable gift annuity, I was happy to support the American Diabetes Association for them to help others. Now the ADA gives me guaranteed income for the rest of my life. There isn't a lot you can count on these days and I am grateful for the ADA. It's a win-win.

—William Trotter

Summit Circle Member

SOUTH CAROLINA

Share your annuity with another or enjoy larger payments that begin later.

At the ADA, we know everyone has a unique life with unique needs. If you’re considering a charitable gift annuity and have someone else you’d like to financially support as well, you may want to consider a two-life annuity. The rate of the annuity is based on the ages of both people and at a lower amount per distribution, but twice the enjoyment and financial security. Income will continue through the longer lifetime.

It’s also possible to create a deferred gift annuity. Using this option, your gift to the ADA is completed now, and you enjoy an immediate income tax deduction for a portion of the amount donated. You’ll receive income later, but the payments will be larger than if you choose to receive them now.

Still have questions? Email plannedgiving@diabetes.org or call 888-700-7029.

*Not available in all states, required minimum must be met, and the information provided should not be taken as tax or legal advice, please consult your advisors.